KYC & KYB workflows

Create KYC and KYB forms without code — in minutes. Use templates or start from scratch. Set rules to send the right form to the right user, review submissions with your team, and connect tools for ID checks, AML, and sanctions screening.

Great for finance, retail, marketplaces — any business that needs quick and trusted verification

We’re more flexible than you ever imagined

The solution lets companies create flexible onboarding workflows with any level of sophistication, code-free

We’ve got

you covered

you covered

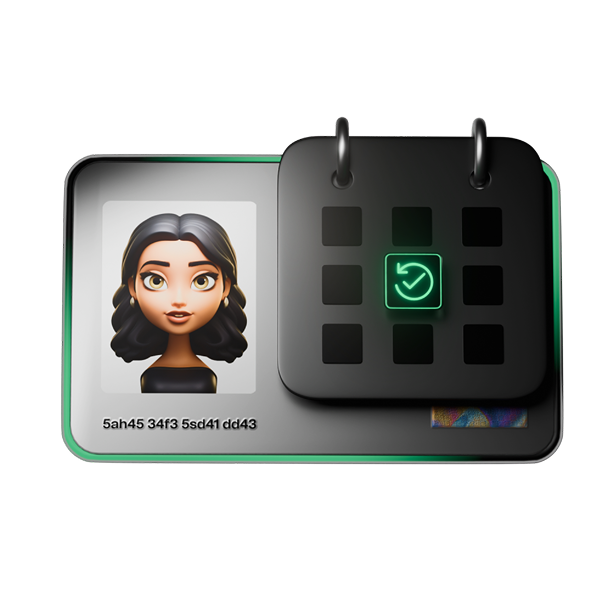

KYC and KYB Verification Flow

Create custom onboarding forms for any use case

Applicants fill out the forms

Company representatives are automatically verified

All data can be revised in our OS or in your system via our API

To stay compliant, we provide a continuous monitoring

You make the final decision on contracts

KYB AS seamless as KYC

Innovations

See how our innovative solution transforms onboarding and compliance.

Created the world's first holistic, no-code platform for building fully custom KYC/KYB onboarding workflows for different industries and client types, custom forms and risk rules.

Pioneered the concept of a dedicated CRM for compliance, automating the entire client lifecycle from due diligence, ongoing monitoring to record keeping for regulated businesses.

Architected a uniquely secure, non-custodial data encryption protocol ensuring end-to-end cryptographic security and GDPR/DORA compliance.

Integrated team collaboration/

Built an API-driven ecosystem with a powerful decision engine, integrated with major sanctions/PEP databases and providers.

KYCB was born from seeing compliance as a constant friction point for scaling businesses. We asked: what if regulatory onboarding could be as flexible and secure as the rest of a company’s tech stack?

We built a platform that turns compliance from a static, costly procedure into a dynamic, strategic asset. By giving businesses a ‘constructor’ for their own unique workflows, we empowered them to own their compliance journey entirely, blending unparalleled security with ultimate flexibility.

Secure & Compliant verification

Comply with FinCEN, FINRA, FCA, FINTRAC, CySEC, and other regulatory requirements using our comprehensive suite of in-house verification capabilities. Easily adapt workflows to different regulations by combining advanced verification tools with both global and local data sources, ensuring the highest level of onboarding assurance.

Security and compliance are our top priorities. Our platform adheres to the most stringent industry standards, safeguarding your data and your customers’ data at all times

Want to learn more about the product? Book a demo.

Ready to start

Create an account and get access to our platform

Integrate with our API for seamless functionality

Start building forms tailored to your needs using our intuitive drag-and-drop interface

Send forms to your customers and start collecting data instantly

frequently

Asked questions

You can configure required fields, add your own questions, and embed the form into your product.

Admins can invite teammates, assign permissions, and monitor progress in real time.

Activity logs ensure transparency and traceability across all verification actions.